The insurance sector achieves record growth, driven by agents’ strong performance and innovative strategies shaping the industry’s future.

Sayfa İçerikleri

ToggleFollowing the release of the cumulative data for 2025 by the Turkish Insurance Association (TSB), the sector’s positive trend was evident in the figures. Abdurrahman Köse, President of the Stronger Agents Platform, who interpreted the data, noted that the strong momentum observed in both life and non-life branches offers significant optimism for 2026.

Historical Real Growth in the Health Segment: 18.5%

Köse, examining the results in detail, highlighted the remarkable performance in the Disease and Health branch in particular. He remarked, “It is clear that the total production in the Disease-Health sector has surpassed 211 billion TL. Compared to last year, there has been a 55% nominal growth. What genuinely pleases us is the 18.51% real growth adjusted for inflation. This demonstrates that citizens’ awareness of health insurance is rising and that our agents are effectively communicating this product. Expansion in the healthcare market reflects a stronger portfolio for agents.”

Discussing the data related to life insurance, Köse pointed out that the improvements in this field are directly connected to financial literacy and agents’ advisory roles. He continued, “Analyzing the life insurance statistics, we see that leading companies in the sector have achieved production growth surpassing 100%. For instance, the top company reported 56% real growth. This isn’t solely a credit-linked insurance success—it is proof that agents have taught citizens the importance of safeguarding their future. Life insurance is no longer a secondary product for our agents; it has become a major source of revenue.”

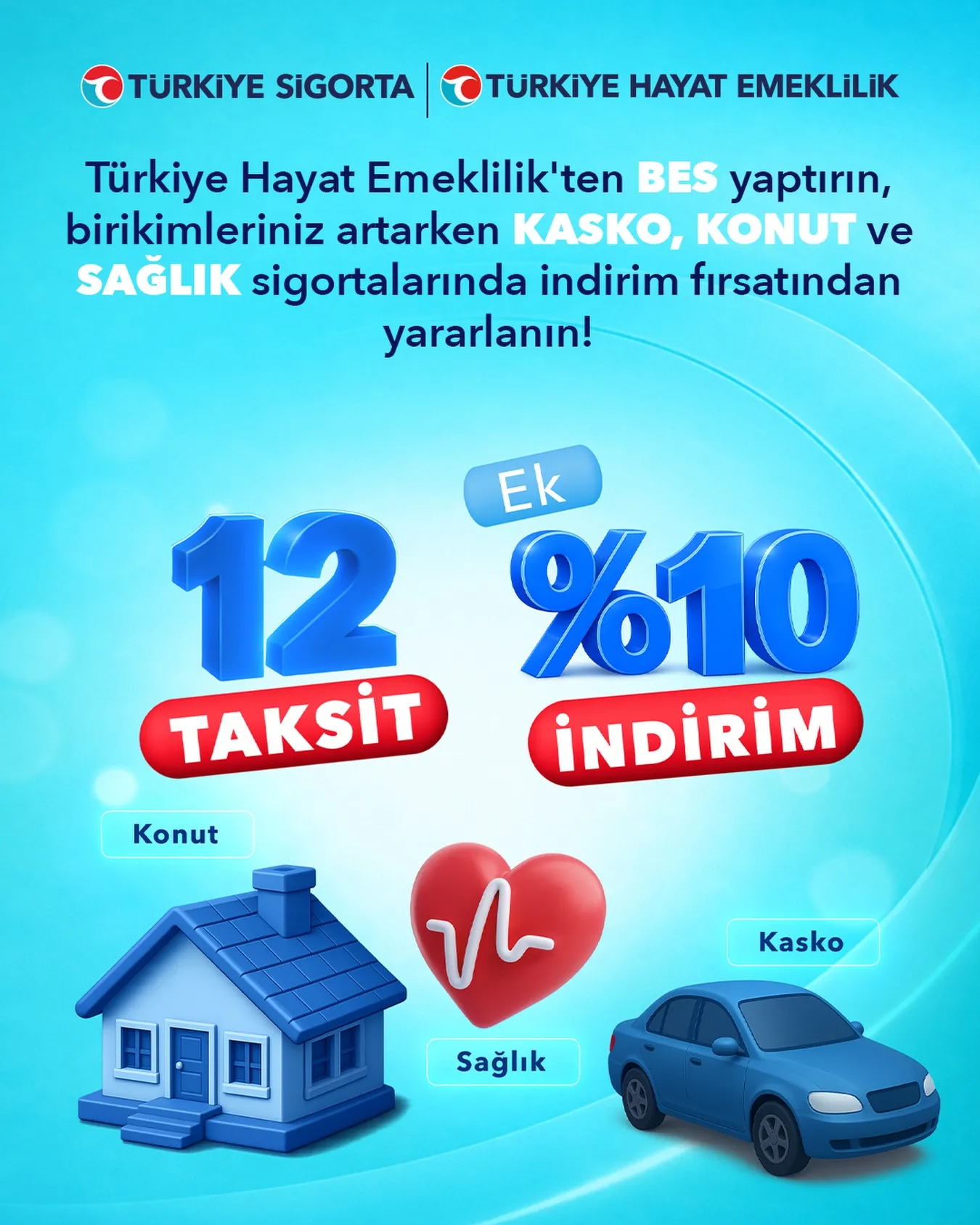

Köse also reviewed production figures in the automotive and accident segments (Comprehensive and Traffic Insurance), emphasizing stability despite economic challenges: “Overall, key players such as Türkiye Sigorta, Allianz, and Anadolu Sigorta have achieved production increases ranging from 40% to 45%. Total output in the accident branch has risen above 23 billion TL. Despite rising vehicle prices, the main reason citizens continue their comprehensive and traffic insurance is the trust they have in their agents who support them throughout the claims process.”

Concluding his remarks, Abdurrahman Köse addressed agents directly, underscoring their crucial role and the ongoing mission of the Stronger Agents Platform: “The data clearly indicate that the sector is expanding in real terms. People talk about digitalization and artificial intelligence, but we, as agents, are the ones generating a significant portion of the 211 billion TL in health premiums and the 147 billion TL in production of leading companies. We are the link to the people, the ones who inform and guide them. The 2025 results are our report card—and it is full of top marks. As the Stronger Agents Platform, we will keep working tirelessly to enhance the share of this success that belongs to agents.”

Sigortahaber.com, sigorta sektöründeki en güncel haberleri, analizleri ve gelişmeleri tarafsız bir bakış açısıyla sunan bağımsız bir haber platformudur. Sigorta profesyonellerine, acentelere ve sektöre ilgi duyan herkese doğru, hızlı ve güvenilir bilgi sağlamayı amaçlıyoruz. Sigortacılıktaki yenilikleri, mevzuat değişikliklerini ve sektör trendlerini yakından takip ederek, okuyucularımıza kapsamlı bir bilgi kaynağı sunuyoruz.

Yorum Yap