Explore key takeaways and trends from the 67th Monte Carlo Reinsurance Meetings, highlighting industry insights and future opportunities.

The 67th Monte Carlo Meetings were a pivotal convergence for leaders in insurance and reinsurance, held from October 6 to 10. Uğur Gülen, President of the Turkish Insurance Association, shared his valuable insights from the event, capturing the pulse and dynamics of the global reinsurance market.

The Monte Carlo Reinsurance Meetings are renowned for their informal yet highly impactful nature. Each September, Monaco becomes the hub for thousands of insurance professionals globally. Unlike conventional conferences, Monte Carlo thrives on personal interactions, with key discussions occurring in hotel lobbies, cafes, and hallways. CEOs and reinsurance moguls engage in pivotal talks about upcoming pricing, while brokers move from one meeting to another, facilitating year-end renewals. Evening gatherings continue the day’s intense networking in a more relaxed ambiance.

From Volatility to Market Equilibrium

The global reinsurance market has faced significant challenges due to post-pandemic inflation, climate-induced disasters, and strict interest rate policies. These events led to a rise in insurance demand, while supply lagged, resulting in increased prices and more stringent risk underwriting. By the end of 2023, the market achieved price stability, marking the highest point in a decade. Recent indicators show a trend towards a softer market from 2025 onward, characterized by declining prices and improved conditions.

Reflections on the Turkish Insurance Sector

The developments are promising for Turkey’s insurance landscape. Turkey heavily relies on reinsurance capital, especially to mitigate earthquake risks—their most critical disaster threat. Discussions at the Monte Carlo Meetings with leading reinsurers indicate a likelihood of reduced costs in 2025, supported by a resilient sector despite major losses from incidents like forest fires in Los Angeles. The prevailing sentiment is one of discipline and resilience moving forward.

The Reinsurance Financial Horizon: Capital and Profitability

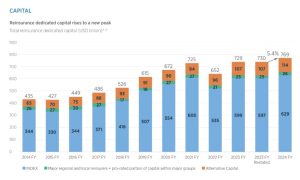

Recent data from Galleger Re’s 2024 report provides a snapshot of this positive shift:

Reinsurers will need to embrace more risk to maintain technical income as prices drop, conditions ease, and economic factors stabilize—an optimal scenario for insurers refining reinsurance needs.

Strategic Pillars for Future Success

As the reinsurance sector increasingly favors buyers, three key success factors emerge:

Ultimately, short insurance cycles—lasting just 2-3 years—pose opportunities amidst global uncertainties. To thrive, Turkey’s insurance sector must prioritize customer centricity, technological advancement, and strategic global alliances.

Sigortahaber.com, sigorta sektöründeki en güncel haberleri, analizleri ve gelişmeleri tarafsız bir bakış açısıyla sunan bağımsız bir haber platformudur. Sigorta profesyonellerine, acentelere ve sektöre ilgi duyan herkese doğru, hızlı ve güvenilir bilgi sağlamayı amaçlıyoruz. Sigortacılıktaki yenilikleri, mevzuat değişikliklerini ve sektör trendlerini yakından takip ederek, okuyucularımıza kapsamlı bir bilgi kaynağı sunuyoruz.