Explore the unprecedented rise in global reinsurer capital in 2024, highlighting key factors fueling this significant financial growth.

In 2024, the global reinsurer capital saw a substantial increase of almost 7%, reaching an unprecedented level of $715 billion. This growth was primarily fueled by strong retained earnings and a burgeoning catastrophe bond market, as reported by Aon, a leading insurance and reinsurance broking firm.

Aon’s April 2025 Reinsurance Market Dynamics report delves into significant market trends in relation to the April 1st, 2025, reinsurance renewal period. Aon described this period as competitive, with most buyers experiencing improved pricing and robust levels of capacity along with heightened reinsurer appetite.

According to Aon, the reinsurance sector’s capital has never been higher. It increased by $45 billion from the end of 2023 to the end of 2024, culminating at $715 billion. “The total was unchanged in the fourth quarter, driven by the earnings impact of Hurricane Milton and the strengthening of the U.S. dollar,” noted Mike Van Slooten, Head of Market Analysis, and Richard Pennay, CEO of Insurance-Linked Securities at Aon.

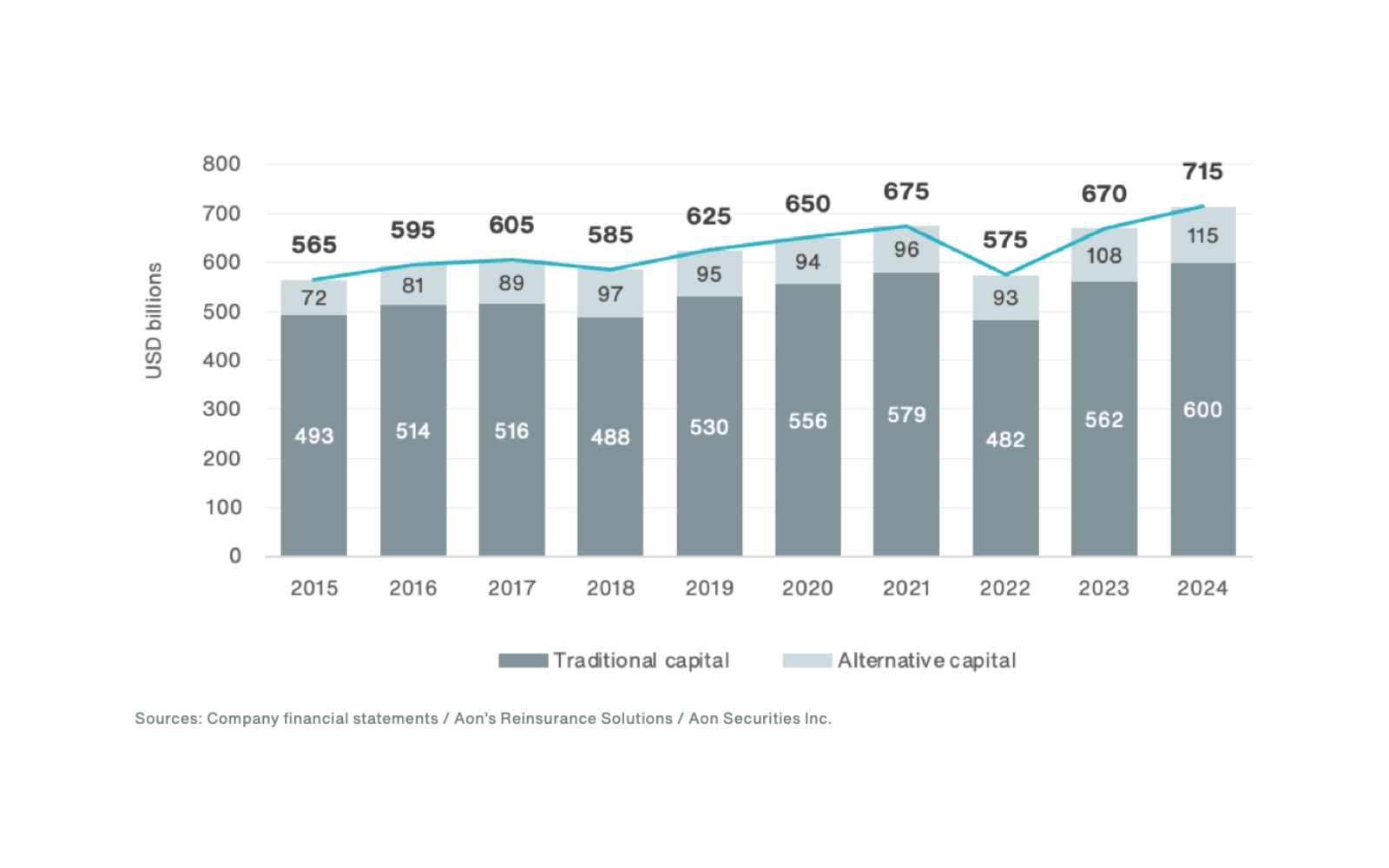

Traditional reinsurer capital expanded by about 7%, translating to a $30 billion increase, reaching $600 billion by the end of 2024. Notably, this figure surpasses the total reinsurer capital, which includes alternative capital, recorded in the years 2015, 2016, 2018, and 2022. Alternative reinsurance capital also experienced growth, increasing by 6.5% to a record $115 billion from $108 billion in 2023. Aon attributed this rise to favorable market conditions, which motivated existing participants to reinvest profits and attracted new entrants to the market.

The chart provided by Aon illustrates the long-term growth in traditional, alternative, and total reinsurer capital since 2015, showing a significant 27% increase in total capital from the end of 2015 to the end of 2024.

Commentary on Traditional and Alternative Capital

Regarding traditional capital, Van Slooten and Pennay remarked, “Most companies tracked showed a second consecutive year of strong top-line growth in 2024, with reinsurance generally outpacing insurance at hybrid carriers. Retained business grew even faster, thanks to previously achieved rate increases that improved attritional loss ratios.”

Underwriting results in 2024 were generally robust, albeit slightly weaker than the previous year. The average combined ratio among 30 companies surveyed was 91.7 percent, up from 90.3 percent in 2023, largely due to an active Atlantic hurricane season.

Discussing the alternative capital market, the pair highlighted, “Alongside the robust growth of the catastrophe bond market, the broader Insurance-Linked Securities (ILS) market saw further expansion in sidecar capital, pushing alternative capital to nearly $115 billion. This growth aligns with prior quarters’ themes, driven by strong investor returns funded by cedents whose capital demand has grown due to inflation, evolving risk views, and broader dynamics in traditional reinsurance and capital markets.”

As reinsurance capital continues to grow and meet increasing demand, Aon anticipates more than $7.5 billion in additional US property catastrophe limit demand heading into mid-year renewals. “We also expect further reinsurance purchasing from U.S. national carriers aiming to mitigate major net losses during 2025,” the broker elaborated.

Sigortahaber.com, sigorta sektöründeki en güncel haberleri, analizleri ve gelişmeleri tarafsız bir bakış açısıyla sunan bağımsız bir haber platformudur. Sigorta profesyonellerine, acentelere ve sektöre ilgi duyan herkese doğru, hızlı ve güvenilir bilgi sağlamayı amaçlıyoruz. Sigortacılıktaki yenilikleri, mevzuat değişikliklerini ve sektör trendlerini yakından takip ederek, okuyucularımıza kapsamlı bir bilgi kaynağı sunuyoruz.

Yorum Yap