Explore Indonesia’s booming health insurance market poised for substantial growth, driven by policy reforms and increasing demand.

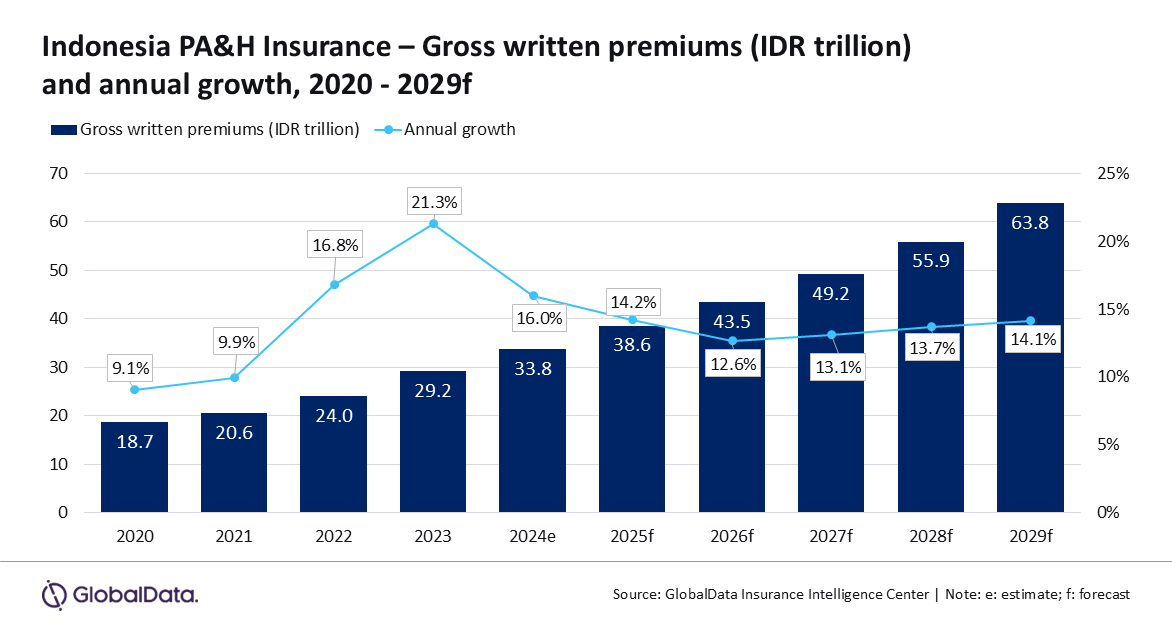

Indonesia’s personal accident and health (PA&H) insurance sector is on track to surpass IDR63.8 trillion (approximately US$4 billion) in gross written premiums (GWP) by 2029, according to GlobalData, a leading analytics firm. This segment is anticipated to grow at a compound annual growth rate (CAGR) of 13.4% from 2025, when the GWP is projected to reach IDR38.6 trillion (US$2.4 billion).

Forecasts from GlobalData suggest that the PA&H segment’s contribution to the overall insurance industry will increase notably, rising from 13.6% of total GWP in 2025 to 16.7% by 2029. The growth in 2025 alone is expected to reach 14.2%, driven by increasing demand for private health coverage and premium adjustments.

Key Drivers of Growth

In response, insurers are adjusting premiums to maintain coverage levels. “This robust expansion is fueled by heightened health and financial awareness, which has increased demand for health insurance products. Additionally, adjustments in premium prices to counteract inflation, along with a resurgence in the tourism industry, are expected to further enhance the growth of PA&H insurance,” Vangari explained.

Shifting Strategies and Challenges

Gross claims in the PA&H segment are expected to rise, with GlobalData projecting a CAGR of 10.9% between 2025 and 2029. Total claims are estimated to grow from IDR8.6 trillion (US$535.9 million) in 2025 to IDR13.1 trillion (US$816.3 million) by the end of the forecast period.

Vangari noted that medical inflation, particularly rising costs of imported pharmaceutical components and medical devices, is contributing to higher claims. “The increasing claims ratio is partly due to medical inflation, driven by soaring expenses for pharmaceutical ingredients and medical devices. Furthermore, the devaluation of the local currency exacerbates pricing challenges, as most pharmaceutical raw materials and medical devices are imported,” she said.

Regulatory and Market Developments

In response to rising claims and cost pressures, Indonesia’s Financial Services Authority (OJK), in collaboration with the government, is drafting a new Circular Letter (RSEOJK) aimed at aligning benefits between insurance providers and the nation’s public health system. This proposal includes mandatory co-payments of at least 10% for outpatient services, aimed at curbing unnecessary medical service usage and reducing insurers’ exposure to high claims ratios.

The growth of Indonesia’s tourism sector is also impacting the PA&H market. As reported by the Central Statistics Agency, international tourist arrivals reached 13.9 million in 2024, a five-year high. This increase in inbound travel is boosting demand for accident and short-term health insurance coverage.

Despite facing challenges, the PA&H segment is being shaped by advancements in digital platforms and product innovation. “Insurers are progressively adopting technology to develop more flexible products that meet market needs. Moreover, the implementation of stricter regulations is expected to enhance the industry’s stability,” Vangari concluded.

Sigortahaber.com, sigorta sektöründeki en güncel haberleri, analizleri ve gelişmeleri tarafsız bir bakış açısıyla sunan bağımsız bir haber platformudur. Sigorta profesyonellerine, acentelere ve sektöre ilgi duyan herkese doğru, hızlı ve güvenilir bilgi sağlamayı amaçlıyoruz. Sigortacılıktaki yenilikleri, mevzuat değişikliklerini ve sektör trendlerini yakından takip ederek, okuyucularımıza kapsamlı bir bilgi kaynağı sunuyoruz.

Yorum Yap