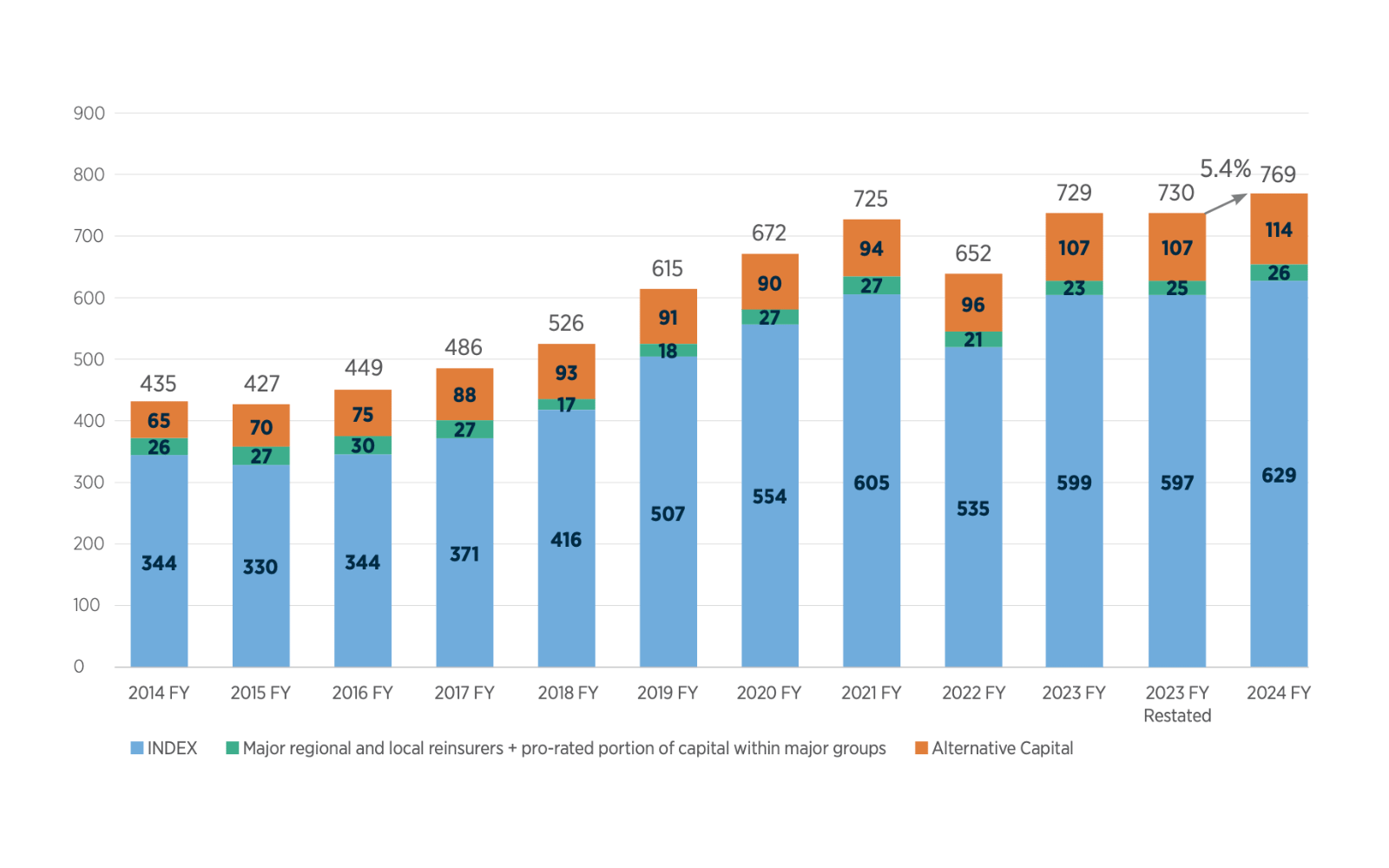

The total dedicated capital in the reinsurance sector has experienced a significant 5.4% increase in 2024, setting a new record at $769 billion. This growth has been driven by expansions in both traditional and alternative capital avenues, as highlighted by reinsurance broker Gallagher Re. Their comprehensive full-year 2024 market report provides an in-depth analysis of the global reinsurance industry, shining a light on a year marked by substantial capital accumulation fueled by robust retained earnings.

According to Gallagher Re’s findings, dedicated reinsurance capital surged from $730 billion at the close of 2023 to $769 billion by the end of 2024. Of this record figure, the capital allocated to INDEX companies, which represent over 80% of the industry’s capital, saw a 5.3% rise, reaching $629 billion. This increase is attributed to retained profits and a strong net income of $117 billion, partially offset by $58 billion in capital returns and $23 billion in unrealized investment depreciation.

Meanwhile, non-life alternative reinsurance capital, excluding life, accident and health ILS AuM and mortgage ILS AuM, expanded by 6.6% year-on-year to hit $114 billion, buoyed by a record-setting year for the catastrophe bond market. Gallagher Re notes, “Global reinsurers’ capital adequacy is not only rising on a financial accounting basis but also remains robust on an economic basis, which we consider more pertinent for strategic decision-making by management teams.”

Furthermore, the average solvency of the top four European reinsurers remained robust at 265% (down slightly from 273% in 2023), which still stands well above the upper target solvency range set by these firms.

The below chart provided by Gallagher Re illustrates the growth trajectory of total reinsurance capital since 2014. It shows an impressive approximately 77% increase in total dedicated reinsurance capital, with the INDEX companies experiencing an 83% growth and non-life alternative reinsurance capital expanding by 75% over the same period.