Pepe (PEPE) is trading above the $0.000007 mark as of Tuesday, showing signs of approaching a critical descending trendline. Crypto analyst Manish Chhetri suggests that a breakout could signal a bullish trend for the meme coin. The long-short ratio for PEPE, along with a rise in bullish positions among traders to a one-month high, supports this optimistic outlook. Chhetri anticipates potential double-digit gains for PEPE.

PEPE Prepares for a Possible Uptrend

Since encountering a rejection around its descending trendline on March 27, PEPE’s price has decreased by 18.43% as of Sunday. This trendline aligns closely with the 50-day Exponential Moving Average (EMA) at approximately $0.000008, marking it as a significant resistance zone. A breakout in favor of the bulls could change the current market dynamics. Notably, on Monday, the coin recovered by around 4%, bringing it close to the descending trendline as of Tuesday.

If PEPE manages to break through the descending trendline and close above its 50-day EMA, it could indicate a bullish pattern. This breakthrough might propel PEPE’s price from $0.000008 to revisit its high of $0.00001 from February 14, suggesting a potential 25% hike.

PEPE/USDT Daily Chart Analysis

Indicators Point Towards a Rise

The Relative Strength Index (RSI) on the daily chart is trending upwards towards the neutral mark of 50, currently showing a value of 47. This suggests a decline in bearish momentum. For the bullish trend to sustain, the RSI needs to cross above its neutral threshold to reinforce a recovery rally.

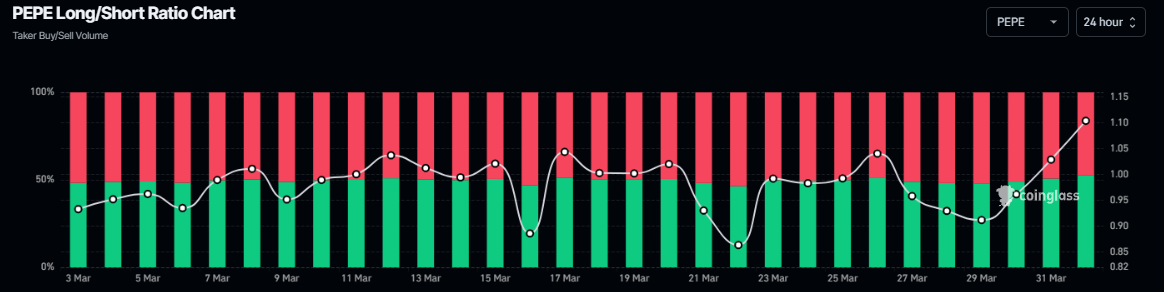

Additionally, Coinglass’ data reveals that PEPE’s long-short ratio has reached a one-month high of 1.01, indicating a bullish sentiment as more traders anticipate a price increase for the meme coin. This ratio surpassing one highlights the prevailing optimistic trend in the market.

PEPE Long-Short Ratio Chart. Source: Coinglass

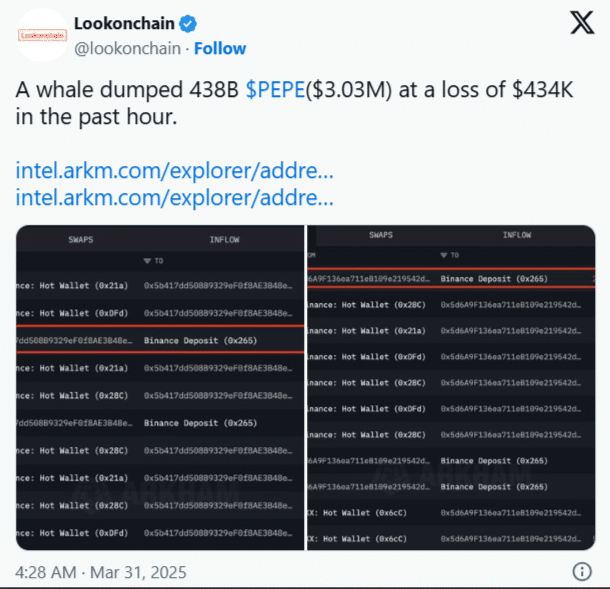

Potential Risks: Whale Activity

Despite the positive indicators, Lookonchain data reported that a whale offloaded 3.03 billion PEPE tokens valued at $438 million on Monday, incurring a loss of $434,000. Such a significant sale could exert downward pressure on PEPE, potentially counteracting the bullish thesis and leading to a price drop. Investors are advised to remain cautious.

OTOMOBİL

2 gün önceSİGORTA

2 gün önceSİGORTA

2 gün önceSİGORTA

3 gün önceSİGORTA

3 gün önceBİLGİ

4 gün önceBİLGİ

4 gün önceSİGORTA

4 gün önceSİGORTA

5 gün önceSİGORTA

5 gün önce 1

DJI Mini 5: A Leap Forward in Drone Technology

20625 kez okundu

1

DJI Mini 5: A Leap Forward in Drone Technology

20625 kez okundu

2

xAI’s Grok Chatbot Introduces Memory Feature to Rival ChatGPT and Google Gemini

14591 kez okundu

2

xAI’s Grok Chatbot Introduces Memory Feature to Rival ChatGPT and Google Gemini

14591 kez okundu

3

7 Essential Foods for Optimal Brain Health

13287 kez okundu

3

7 Essential Foods for Optimal Brain Health

13287 kez okundu

4

Elon Musk’s Father: “Admiring Putin is Only Natural”

13121 kez okundu

4

Elon Musk’s Father: “Admiring Putin is Only Natural”

13121 kez okundu

5

Minnesota’s Proposed Lifeline Auto Insurance Program

11025 kez okundu

5

Minnesota’s Proposed Lifeline Auto Insurance Program

11025 kez okundu

Sigorta Güncel Sigorta Şikayet Güvence Haber Hasar Onarım Insurance News Ajans Sigorta Sigorta Kampanya Sigorta Ajansı Sigorta Sondakika Insurance News