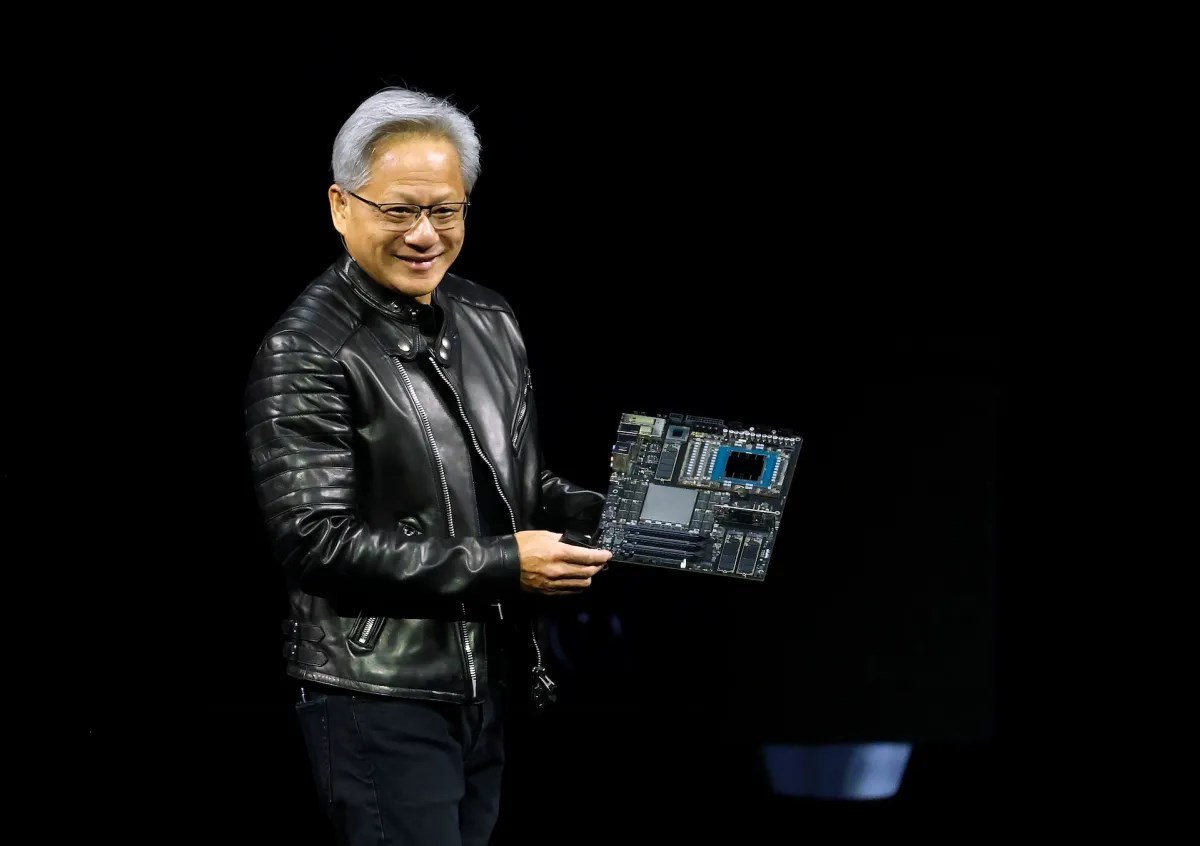

Nvidia, a leading force in artificial intelligence hardware, disclosed a substantial financial burden of $5.5 billion following the United States government’s recent restrictions on chip exports to China. An indefinite export license now governs the sale of its H20 AI chips to China, as announced on Tuesday. This chip represented the pinnacle of Nvidia’s offerings to the Chinese market.

The stock market reaction was swift, with Nvidia shares plummeting by roughly 6 percent in after-hours trading after the announcement. Similarly, AMD, a competitor with equivalent offerings, witnessed a 7 percent decline in its share prices.

The US Department of Commerce has implemented licensing requirements that affect not only Nvidia’s H20 chip but also AMD’s MI308 and other products with comparable performance levels. The concern from US officials centers on the potential use of these powerful chips in China’s supercomputer systems.

Nvidia had tailored the H20 chip specifically to meet previous US export restrictions, aiming to sustain its presence in the Chinese market. Although the H20 excels in output production, it falls short in model training when compared to premium chips. Recent reports indicate a surge in orders for the H20 from Chinese companies.

Nvidia was first informed by the US government on April 9 regarding the licensing requirement and learned on April 14 that the rule would remain in place indefinitely. The company is yet to determine the specific circumstances under which license approvals can be obtained under the new regulation.

The staggering $5.5 billion cost encompasses liabilities related to inventories, purchase agreements, and other reserves. Nvidia has confirmed that this financial hit will be reflected in their current fiscal quarter results.

SİGORTA

7 saat önceOTOMOBİL

3 gün önceSİGORTA

3 gün önceSİGORTA

3 gün önceSİGORTA

5 gün önceSİGORTA

5 gün önceBİLGİ

5 gün önceBİLGİ

5 gün önceSİGORTA

6 gün önceSİGORTA

7 gün önce 1

DJI Mini 5: A Leap Forward in Drone Technology

20639 kez okundu

1

DJI Mini 5: A Leap Forward in Drone Technology

20639 kez okundu

2

xAI’s Grok Chatbot Introduces Memory Feature to Rival ChatGPT and Google Gemini

14599 kez okundu

2

xAI’s Grok Chatbot Introduces Memory Feature to Rival ChatGPT and Google Gemini

14599 kez okundu

3

7 Essential Foods for Optimal Brain Health

13291 kez okundu

3

7 Essential Foods for Optimal Brain Health

13291 kez okundu

4

Elon Musk’s Father: “Admiring Putin is Only Natural”

13125 kez okundu

4

Elon Musk’s Father: “Admiring Putin is Only Natural”

13125 kez okundu

5

Minnesota’s Proposed Lifeline Auto Insurance Program

11028 kez okundu

5

Minnesota’s Proposed Lifeline Auto Insurance Program

11028 kez okundu

Sigorta Güncel Sigorta Şikayet Güvence Haber Hasar Onarım Insurance News Ajans Sigorta Sigorta Kampanya Sigorta Ajansı Sigorta Sondakika Insurance News