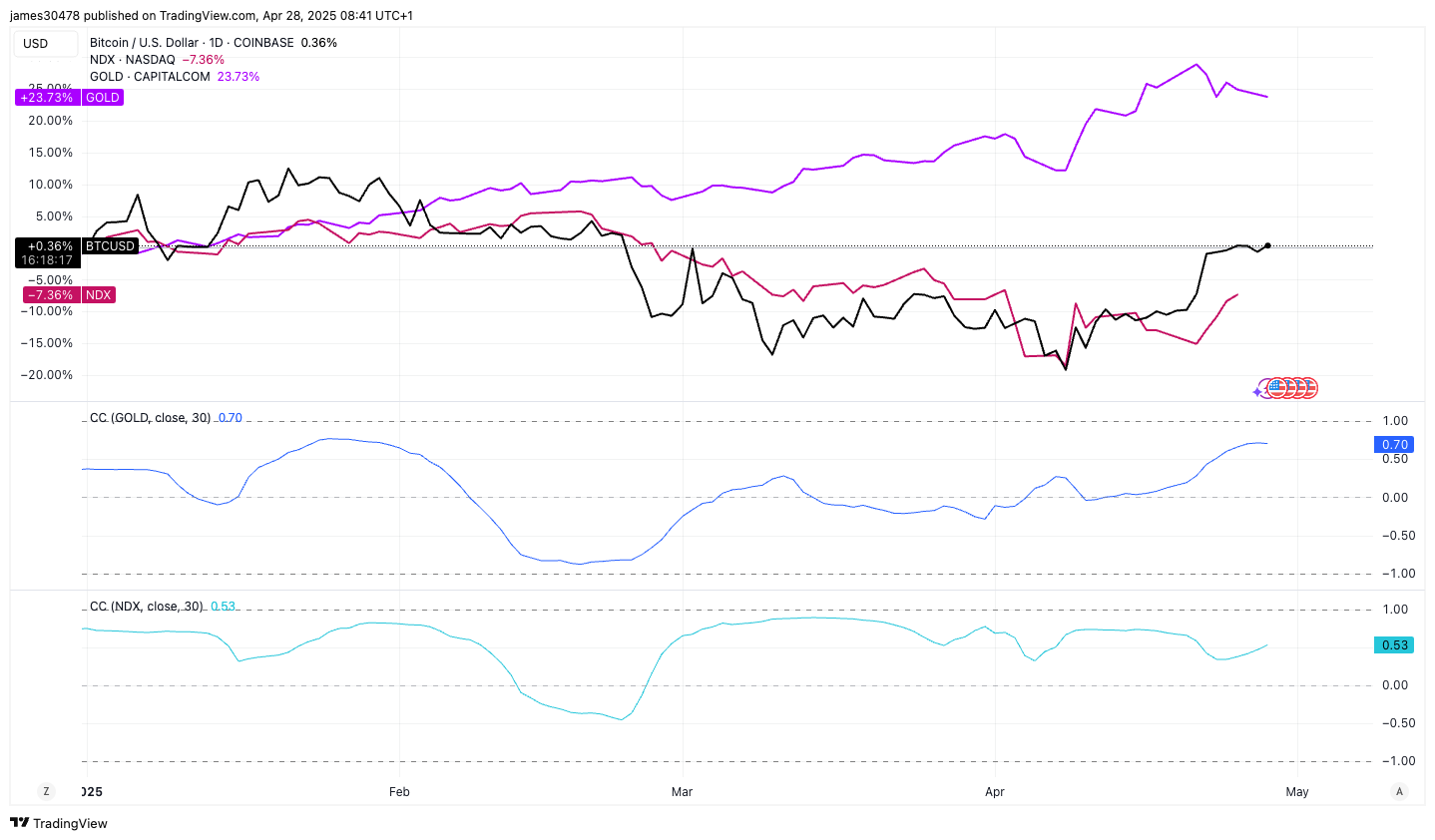

Bitcoin (BTC) has once again entered positive territory for the year, marking a significant turnaround after nearly two months of volatility. The leading cryptocurrency is now nearing the $95,000 mark, successfully erasing a previous decline of up to 18%. This recent uptrend places Bitcoin’s annual performance at a modest increase of less than 1.5% since the beginning of the year. In comparison, gold has seen a notable rise of 24%, while the Nasdaq 100 has experienced a decline of over 7%. The ongoing debate about Bitcoin’s identity—whether it is akin to a leveraged tech stock or serves as digital gold—seems to be tilting slightly in favor of the digital gold narrative, albeit marginally.

Examining Bitcoin’s correlation with other assets on a 30-day moving average reveals interesting insights. Currently, Bitcoin demonstrates a strong correlation coefficient of 0.70 with gold, whereas its correlation with the Nasdaq 100 is comparatively weaker at 0.53. This pattern suggests that Bitcoin’s price movements are increasingly synchronized with gold, rather than technology stocks. Correlation values can range between 1, indicating a strong positive correlation, and -1, signifying a strong negative correlation.

Last week, Bitcoin’s price surged by 10%, marking its strongest weekly performance since the week concluding on November 17, which coincided with the market rally following President Donald Trump’s election victory. This upward momentum comes amid ongoing economic uncertainties fueled by U.S. tariffs on Chinese imports.

The U.S. has recently increased tariffs on Chinese goods to 145%, causing a noticeable decline in cargo shipment demand, as reported by Bloomberg. Major retailers, including Walmart, are cautioning about the potential return of empty shelves and rising prices, reminiscent of the challenges faced during the COVID era.

Source: Coindesk.com

Sigortahaber.com, sigorta sektöründeki en güncel haberleri, analizleri ve gelişmeleri tarafsız bir bakış açısıyla sunan bağımsız bir haber platformudur. Sigorta profesyonellerine, acentelere ve sektöre ilgi duyan herkese doğru, hızlı ve güvenilir bilgi sağlamayı amaçlıyoruz. Sigortacılıktaki yenilikleri, mevzuat değişikliklerini ve sektör trendlerini yakından takip ederek, okuyucularımıza kapsamlı bir bilgi kaynağı sunuyoruz.

Yorum Yap