Apple nears $4 trillion valuation as record-breaking demand for the iPhone 17 fuels investor excitement and market momentum.

Apple has reached new heights after a surge in demand for its latest iPhone 17 series sent shares soaring to record levels. The tech giant is now on the verge of becoming the third company in history to achieve a market valuation of around $4 trillion. Data from Counterpoint reveals that sales of the iPhone 17 have jumped by approximately 14% compared to the iPhone 16 during its first 10 days in key markets like the United States and China.

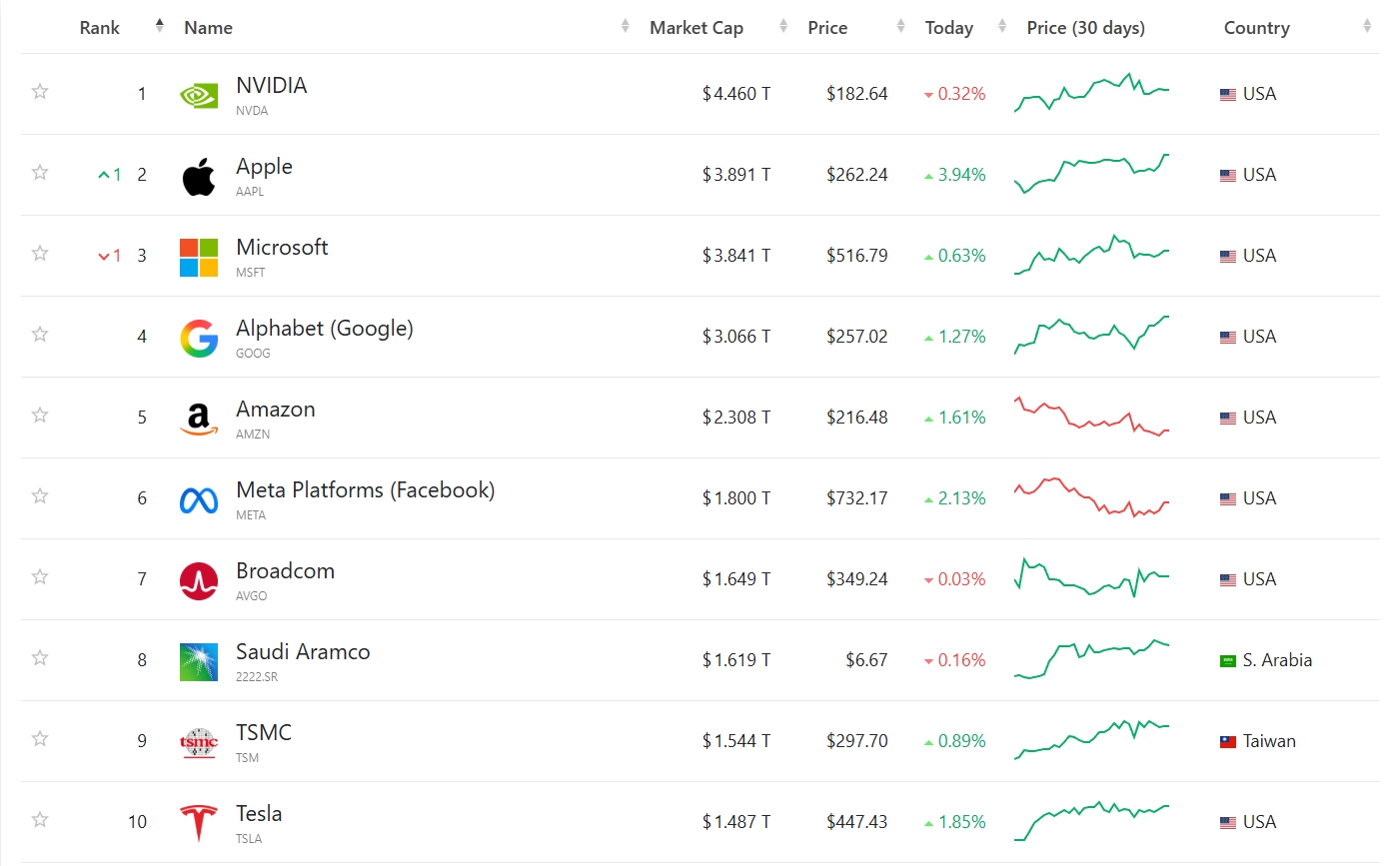

Following these results, Apple’s stock climbed 4.2% to $262.9 per share, pushing its market capitalization to nearly $3.9 trillion — second only to AI chip leader Nvidia. This significant milestone highlights Apple’s enduring influence in global markets and its ability to rebound despite increased competition and economic challenges.

Evercore ISI, a major financial advisory firm, expects Apple to outperform current market forecasts for the present quarter and anticipates an optimistic outlook for the December quarter. Analysts pointed to robust online order activity in China as a key signal of healthy consumer demand. Meanwhile, research firm Omdia recently confirmed that Apple delivered its strongest third-quarter performance on record, showcasing remarkable resilience within a competitive landscape.

In September, Apple unveiled the iPhone 17 lineup, featuring the ultra-slim iPhone Air, while maintaining previous pricing levels. Although the company has been slower than rivals in artificial intelligence integration, its strategic improvements to the core iPhone models appear to have reignited customer enthusiasm, leading to accelerated upgrades across markets.

Earlier this year, Apple faced declining stock pressure amid strong local competition in China and uncertainty over potential trade tariffs. However, the company’s announcement of an additional $100 billion investment in the United States in August significantly restored investor confidence. This move not only boosted its domestic operations but also contributed to a steady recovery in share value.

If the current upward trend continues, Apple is poised to record its most significant daily gain in over a month. Since January, its shares have risen by more than 7%, which, while modest compared to peers, signals steady growth. In contrast, other tech leaders such as Meta have advanced 22%, Alphabet 34%, Microsoft 23%, and Nvidia a striking 34%+. Apple’s next quarterly financial results, scheduled for October 30, are expected to shed further light on how sustained demand for the iPhone 17 will continue to shape its market trajectory.

Apple’s journey toward the $4 trillion benchmark underscores not only its product innovation but also its ability to adapt swiftly in a rapidly evolving tech ecosystem. The iPhone 17’s strong debut may well mark the beginning of another transformative chapter in Apple’s corporate history.

Sigortahaber.com, sigorta sektöründeki en güncel haberleri, analizleri ve gelişmeleri tarafsız bir bakış açısıyla sunan bağımsız bir haber platformudur. Sigorta profesyonellerine, acentelere ve sektöre ilgi duyan herkese doğru, hızlı ve güvenilir bilgi sağlamayı amaçlıyoruz. Sigortacılıktaki yenilikleri, mevzuat değişikliklerini ve sektör trendlerini yakından takip ederek, okuyucularımıza kapsamlı bir bilgi kaynağı sunuyoruz.